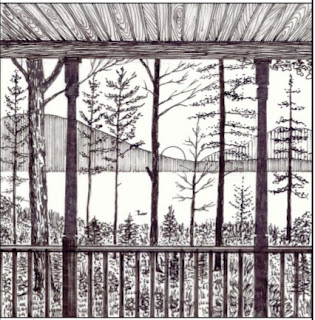

Maine's Shoreland Zoning

Did you know that most land uses within 250 feet of Maine's rivers, wetlands, lakes, the ocean, and within 75 feet of certain streams are subject to the regulation of Maine's Mandatory Shoreland Zoning Act.? The law protects water quality, limits erosion, conserves wildlife and vegetation, and preserves the natural beauty of Maine's shoreland areas. What are considered shoreland areas? All land within 250 feet of the high-water line of any pond over 10 acres, any river that drains at least 25 square miles, and all tidal waters and saltwater marshes. All land within 250 feet of a freshwater wetland over 10 acres. All land within 75 feet of streams that are an outlet of great ponds or streams below the confluence of 2 perennial streams. The municipalities must map these areas and establish districts or zones within these areas for protected districts and residential, commercial or mixed-use districts. Responsible Development Development that is too close to the sh...